What Are Small and Large Business Loans?

Business loans are essential financial instruments designed to provide capital to enterprises at different growth stages. Unlike personal loans tied to individual creditworthiness, business loans are evaluated based on company performance, revenue potential, collateral, and management capability. In 2025-2026, the landscape for small business loans and large business loans has evolved dramatically in response to economic uncertainty and shifting demand patterns.

Small business loans typically range from $5,000 to $500,000, designed for startups, sole proprietors, and growing companies with established revenue. Large business loans exceed $500,000 and extend up to $5.5 million or more through specialized programs, serving expanding enterprises with significant capital needs.

The 2025-2026 Small Business Lending Landscape

The small business lending market in late 2025 presents a paradox of opportunity and constraint. According to recent market data, demand for business loans has reached near-record levels, with entrepreneurs seeking capital to address both operational pressures and expansion opportunities. Specifically:

- Small business funding demand surged significantly in 2025, driven by 56% of businesses citing operational expense needs and 46% pursuing growth strategies

- Traditional banks have tightened credit standards for 13 consecutive quarters, pushing more small businesses toward alternative financing sources

- A notable shift is occurring toward smaller, targeted loan products—with lenders increasingly offering bite-sized working capital facilities below $100,000 thresholds rather than large, multipurpose term loans

- Fintech adoption continues accelerating, with 72% of small business loan applicants now turning directly to non-bank sources for faster approvals

As we approach 2026, anticipated economic recovery and declining Federal Reserve interest rates are expected to create favorable borrowing conditions. Well-positioned businesses that plan ahead can capitalize on improved lending environments and lower business capital loan rates.

Government-Backed vs. Non-Government Business Loans

Government-backed business loans (primarily SBA loans) offer distinct advantages including government guarantees reducing lender risk, competitive interest rates, and flexible terms. Non-government business loans from private lenders and fintech companies often provide faster approval timelines but typically feature higher interest rates.

What We Offer

Mountaintop Capital Partners LLC specializes in structured funding solutions with 100+ deal teams and hundreds of millions in combined transaction experience. We provide tailored business loans for small business and enterprise-level financing across a comprehensive range of programs:

Core Business Loan Programs

Our primary offerings serve different business needs and growth stages:

SBA 7(a) Loans - Our most versatile program, offering up to $5 million for working capital, equipment, real estate, and debt refinancing. These SBA loans feature terms extending to 25 years and represent the ideal choice for most small-to-medium enterprises. With interest rates currently ranging from 10.5%-15.5%, 7(a) loans provide the flexibility that characterizes the backbone of American small business financing.

SBA CDC/504 Loans - Specialized for fixed asset acquisition, 504 loans provide up to $5.5 million with extended terms (10-25 years) and lower interest rates than 7(a) products. These loans excel for commercial real estate purchases, construction, equipment acquisition, and business modernization. The 10% down payment requirement makes 504 loans particularly attractive for capital-intensive projects.

SBA Microloans - Ideal for startups and very small enterprises, microloans provide up to $50,000 with shorter terms. These business loans for startups often include business counseling and support services, making them perfect for first-time entrepreneurs and businesses under two years old.

Specialized Financing Solutions

Beyond traditional SBA programs, we offer:

Purchase Order Financing - A specialized working capital solution for companies with confirmed customer orders but insufficient operating capital to fulfill production. This business capital loan type directly finances manufacturing and procurement costs, enabling growth without disrupting operations.

Invoice Financing & Accounts Receivable Financing - B2B companies can unlock capital tied up in unpaid customer invoices, receiving 80-90% advance rates within 24-48 hours. This solution addresses the "cash flow gap" that plagues growing service firms and distributors.

Short-Term Loans - For immediate, temporary capital needs, short-term business financing provides quick access (sometimes same day) without lengthy underwriting, perfect for seasonal businesses or unexpected operational requirements.

Business Lines of Credit - Revolving credit facilities providing flexible access to capital as needed, ideal for managing cash flow fluctuations and unexpected expenses without repeatedly applying for new loans.

Online Term Loans - Rapid-approval alternative financing through digital platforms, streamlining application, underwriting, and fund disbursement for businesses prioritizing speed.

Rollover for Business Startups (ROBS) - A specialized retirement account strategy allowing business owners to fund startups using qualified retirement savings without triggering penalties or creating immediate tax liability.

Nonprofit Business Loans - Tailored programs for qualified nonprofit organizations seeking capital for expansion, equipment, or facility improvements with terms reflecting tax-exempt status.

Medical Practice Financing - Healthcare professionals benefit from specialized underwriting recognizing the unique cash flow and profitability patterns of medical, dental, and specialized practices. These business loans address practice startup, expansion, equipment, and refinancing needs.

Apparel & Entertainment Lending - Specialized products for wholesale, distribution, and retail companies in these capital-intensive, seasonally volatile sectors.

Emerging Alternative Solutions

In response to 2025's tightening traditional credit environment, we're actively evaluating emerging solutions:

- Revenue-Based Financing (RBF) for high-growth startups preferring equity-free capital with flexible repayment tied to revenue performance

- Cash Flow-Based Lending emphasizing business revenue generation capacity over credit scores and collateral

- Peer-to-Peer Lending connections for small business owners seeking community-based capital sources

- Supply Chain Financing connecting suppliers, distributors, and buyers with working capital solutions

Why Business Owners Choose Mountaintop Capital Partners for Business Loans?

Extensive Experience and Expertise

With 100+ deal teams and hundreds of millions in combined transaction experience, our financial professionals bring deep sector knowledge and underwriting sophistication to every business loan application. Our team includes seasoned credit professionals with experience across startup financing, SBA programs, and specialized industry lending.

Comprehensive Loan Products

From small business start up loans under $50,000 to complex financing structures exceeding $5 million, our diverse product suite ensures we can structure solutions matching your specific needs. Whether seeking startup business loans, business financing for working capital, or business capital loans for acquisition, we have appropriate programs.

Disciplined Underwriting

Our structured underwriting process evaluates:

- Cash flow and business fundamentals (targeting debt-service coverage ratios of 1.25x minimum)

- Owner creditworthiness and credit profile

- Industry conditions and competitive positioning

- Collateral quality and secondary repayment sources

- Management team capability and business plan viability

This rigorous approach protects both our clients and investors while ensuring appropriate loan sizing and structuring.

Clear Documentation and Transparency

Complete loan documentation specifies all terms, conditions, fees, interest rates, and repayment schedules upfront. No hidden costs or surprise fees. Our commitment to transparency builds trust and enables business owners to make informed decisions.

Precise Execution

From initial application through disbursement and ongoing administration, we manage each transaction with operational precision ensuring timely, efficient closing and funding delivery.

Customized Structuring

One size does not fit all. We structure solutions reflecting business-specific cash flows, seasonal patterns, growth trajectories, and collateral profiles. A wholesale distribution company's financing differs fundamentally from a medical practice—our structuring reflects these realities.

Relationship-Focused Approach

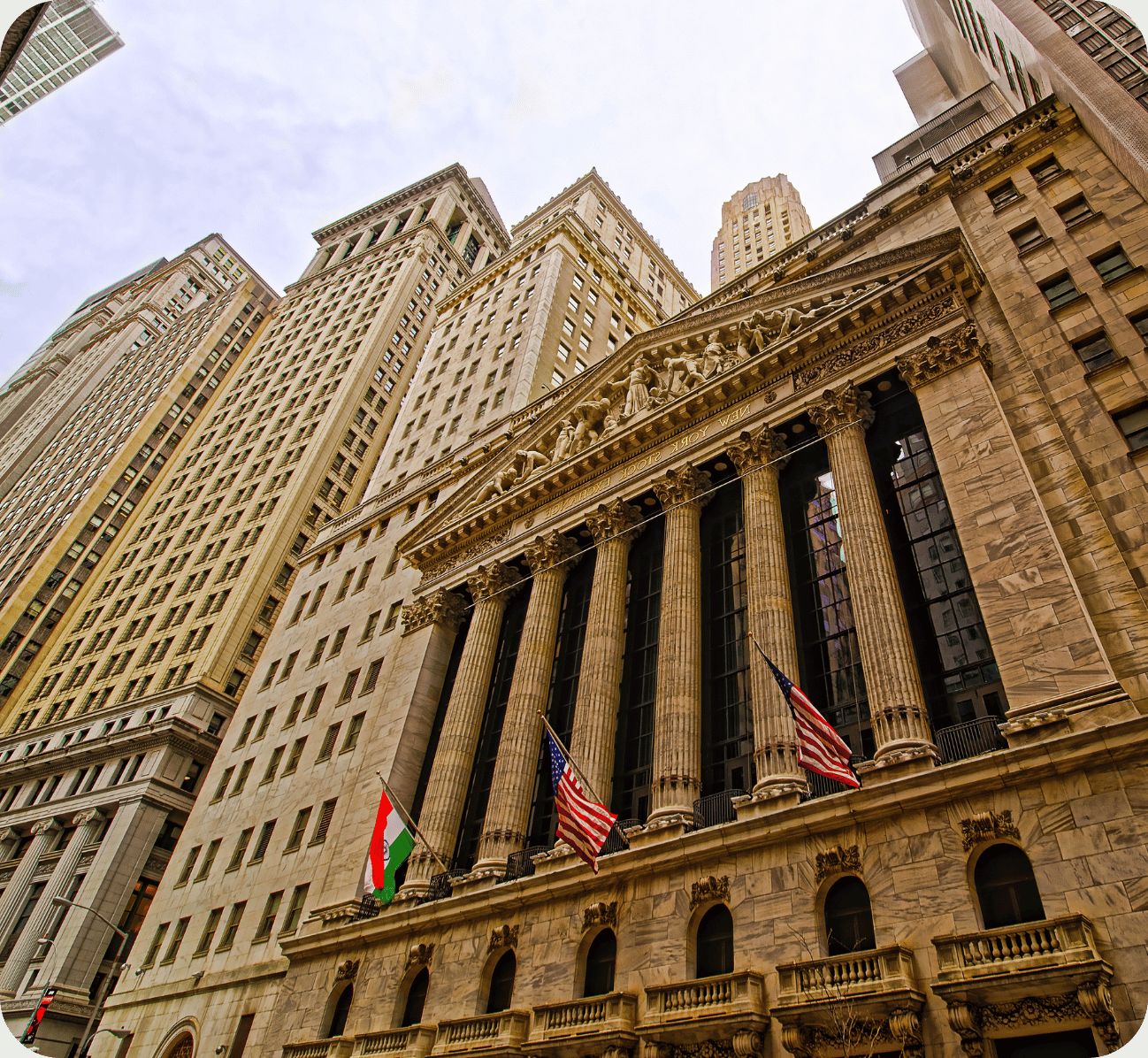

As a Wall Street-based firm, we maintain institutional relationships and capital sources while treating each client with personalized attention. We view lending as a partnership, not a transaction.

Competitive Interest Rates

While specific rates depend on loan type, credit profile, and market conditions, our extensive lender network enables competitive pricing. Current SBA 7(a) rates typically range 10.5%-15.5%, with 504 loans offering lower fixed rates for fixed asset financing.

Flexible Down Payment Requirements

SBA programs typically require 10% owner equity injection, though 504 loans maintain this 10% standard specifically for fixed assets. Other programs may feature different requirements reflecting loan type and collateral position.

Extended Repayment Terms

Loan terms extending to 25 years for real estate and other fixed assets reduce monthly payment burdens, improving cash flow management and business sustainability.

No Prepayment Penalties on Most Programs

Unlike some traditional bank loans, many SBA programs allow prepayment without penalty, giving businesses flexibility to accelerate payoff as cash flow improves.

Find the Right Loan to Accelerate Your Small or Large Business Growth

Selecting the optimal business loan for your enterprise requires matching your capital needs, timeline, and collateral position with appropriate financing products.

Matching Your Business Needs to the Right Loan Product

If you need: Working capital for inventory, receivables, operating expenses, payroll, or seasonal needs

Consider: Business lines of credit, short-term loans, invoice financing, or SBA 7(a) loans

If you need: Funding for equipment, machinery, or technology purchases

Consider: SBA 7(a) loans, equipment financing lines, or purchase order financing

If you need: Capital for commercial real estate acquisition, construction, or major facility improvements

Consider: SBA 504 loans (offering 25-year terms and lower fixed rates) or commercial real estate-focused 7(a) loans

If you're starting a new business and lack operating history

Consider: Startup-focused SBA loans, microloans, ROBS strategies, or SBA Express programs emphasizing business plan viability

If you have confirmed customer orders but lack production capital

Consider: Purchase order financing or pre-shipment working capital lines

If your capital is tied up in unpaid customer invoices

Consider: Invoice financing or accounts receivable factoring providing same-week capital access

If you're a medical professional, dentist, or healthcare entrepreneur

Consider: Specialized medical practice financing with underwriting recognizing healthcare cash flow patterns

If you need rapid approval (within days rather than weeks)

Consider: Online term loans, short-term products, or alternative fintech solutions

If you want to minimize personal collateral for startup or early-stage businesses

Consider: SBA microloan programs or revenue-based financing

Assessment Questionnaire: Which Loan Type Fits Your Business?

To determine your best-fit financing solution, consider:

- What is your capital need amount? ($5K-$50K, $50K-$500K, or $500K+?)

- What is the primary use of funds? (Working capital, equipment, real estate, debt refinance, startup costs?)

- When do you need the funds? (Urgent/weeks, moderate/1-2 months, flexible/2-3+ months?)

- What assets can you pledge as collateral? (Real estate, equipment, inventory, business receivables?)

- What is your business stage? (Startup/under 2 years, growth/2-5 years, established/5+ years?)

- What is your personal credit score range? (Excellent 750+, good 680-750, fair 630-680, challenged <630?)

- What is your business annual revenue? (None yet, <$250K, $250K-$1M, $1M+?)

Your answers guide strategic discussions with our financing specialists to identify optimal loan products and structures

Loan Approval Steps: Your Path from Application to Funding

Understanding the loan approval journey demystifies the process and enables better preparation. Most business loan programs follow a similar 5-8 step approval process:

Step 1: Initial Consultation and Loan Program Selection (1-2 Days)

Our loan specialists meet with you to understand your capital needs, business fundamentals, timeline, and goals. Based on this discussion, we recommend appropriate SBA loan programs or alternative financing matching your profile.

What to prepare: Brief overview of your business, capital need amount, timeline, and intended use of funds.

Step 2: Pre-Qualification Assessment (2-3 Days)

Before investing significant time in documentation, we conduct preliminary screening evaluating:

- Business eligibility (legal structure, industry type, size standards compliance)

- Credit profile adequacy (minimum scores, delinquency history)

- Cash flow assessment (approximate revenue and profitability)

- Collateral position (available assets for pledge)

This pre-qualification determines if your application warrants full underwriting, or if alternative strategies better serve your needs.

What to prepare: Personal and business credit authorization forms, basic financial overview (last year's tax return, current year-to-date financials).

Step 3: Comprehensive Documentation Submission (3-5 Days)

Upon pre-qualification approval, you'll assemble complete documentation for underwriting:

Required Personal Documentation:

- Completed loan application (SBA Form 1919 for SBA programs)

- Personal financial statement

- Resume or biography highlighting relevant experience

- Personal identification verification (driver's license, passport)

- Personal and business credit reports authorization

Required Business Documentation:

- Articles of incorporation, business license, and formation documents

- Three years of personal tax returns (all owners with 20%+ equity)

- Three years of business tax returns

- Current year-to-date financial statements (profit & loss, balance sheet)

- Three months of recent business bank statements

- Business plan with revenue projections (especially for startups)

- Detailed use of proceeds breakdown

- Lease agreements or purchase contracts (if applicable)

- Professional licenses (if applicable to your industry)

- Details on existing debt obligations

For Real Estate/Equipment Loans:

- Property appraisal or equipment specifications

- Construction contracts or equipment quotes

- Zoning verification and environmental assessments

The completeness and accuracy of documentation directly impacts approval timeline. Missing or inconsistent paperwork is the #1 reason for processing delays.

Step 4: Credit Analysis and Underwriting (5-10 Days)

Our underwriting team conducts comprehensive credit evaluation:

Analysis of the "5 C's of Credit":

- Character - Payment history, business reputation, industry standing

- Cash Flow - Revenue trends, profitability, seasonal patterns (targeting 1.25x DSCR minimum)

- Capital - Owner equity injection, personal net worth, business net worth

- Collateral - Quality, value, and liquidity of pledged assets

- Conditions - Industry environment, economic outlook, loan structure appropriateness

For SBA programs, we additionally verify:

- 100% beneficial ownership documentation

- Citizenship/legal permanent resident status verification

- SBA size standard compliance

- Ineligible business activity screening

What happens: Underwriters request clarifications, additional documentation, or financial projections refinement as needed. Responsive, prompt answers accelerate underwriting.

Step 5: Loan Committee Decision (2-5 Days)

For larger loans or complex structures, underwriting recommendations go to loan committee for credit decision. Smaller loans may be approved directly by underwriters with appropriate authority.

Possible outcomes:

- Full approval on proposed terms

- Conditional approval requiring modifications (higher interest rate, larger down payment, additional collateral, personal guarantees)

- Request for substantial restructuring

- Decline with explanation

Step 6: Approval and Loan Documentation (3-5 Days)

Upon approval, our loan operations team prepares comprehensive loan documentation including:

- Promissory note

- Security agreement and collateral pledges

- Personal guarantees (as applicable)

- Affidavit forms and certifications

- Loan agreement and terms and conditions

- Disclosure statements and regulatory compliance documentation

- Insurance and hazard requirements

You'll review documentation with legal counsel (recommended) and ask clarifying questions before signing. No surprises or ambiguous terms should exist at this stage.

Step 7: Closing and Fund Disbursement (2-5 Days)

Final loan closing involves:

- Execution of all loan documents

- Verification of insurance and hazard coverage

- Recording of security agreements and liens

- Final compliance review

- Fund disbursement to your business account

For real estate loans, title company involvement and deed recording may extend this timeline. Most closings complete within 2-5 business days of document execution.

Step 8: Post-Funding Administration

Upon disbursement, your loan enters ongoing administration including:

- Loan servicing and payment processing

- Periodic financial reporting requirements

- Compliance monitoring

- Annual financial statement reviews

Typical Timeline Summary:

- Startups/complex structures: 60-90 days from application to funding

- Established businesses with strong documentation: 30-45 days

- Fast-track programs (online term loans): 5-10 days

- Expedited SBA Express programs: 10-15 days

Timeline varies based on completeness of documentation, loan complexity, collateral verification requirements, and seasonal lender volume.

Why Choose Mountaintop Capital Partners for Your Business Loan

1. Institutional Expertise Meets Personalized Service

As a Wall Street-based financial firm with 100+ deal teams, Mountaintop Capital Partners combines institutional sophistication with personalized attention to each client relationship. We're large enough to provide comprehensive solutions yet selective enough to understand your business deeply.

2. Proven Track Record

Our history of delivering hundreds of millions in business financing demonstrates our capability to structure and execute complex transactions. References and case studies showcase our success across diverse industries and business stages.

3. Comprehensive Lender Network

Our extensive relationships with institutional lenders, SBA-approved lenders, banks, credit unions, and alternative capital sources enable us to match your financing need with optimal capital providers. Rather than forcing your business into one lender's box, we shop your deal to appropriate sources.

4. Industry Specialization

Our deal teams focus on specific industries (real estate, healthcare, manufacturing, technology, professional services, etc.), bringing deep sector knowledge to underwriting decisions and loan structuring.

5. Transparent, Honest Guidance

We believe in honest conversations about loan feasibility, realistic terms, and honest timelines. If we believe alternative financing better serves your needs, we'll say so. Your long-term success matters more than any single transaction.

6. Regulatory Compliance and Risk Management

All our professionals maintain current knowledge of SBA regulations, banking regulations, and compliance requirements. We structure transactions ensuring borrower compliance while protecting lender interests.

7. Technology-Enabled Efficiency

Modern loan origination systems, document management, and e-signature capability streamline the application process while maintaining rigorous documentation standards.

8. Dedicated Client Advocate

Each client receives a dedicated relationship manager serving as your primary contact, ensuring consistent communication, progress updates, and issue resolution throughout the approval and funding process.

9. Post-Funding Support

Loan origination is the beginning, not the end, of our relationship. We provide:

- Quarterly check-ins with portfolio companies

- Proactive communication about refinancing opportunities

- Support navigating SBA compliance requirements

- Guidance on additional capital needs as businesses grow

Addressing Common Loan Application Concerns

Startup Without Operating History Can Qualify

Many business owners believe startups cannot obtain financing. While startup approval requires additional scrutiny, qualifying pathways exist:

- SBA microloans explicitly serve newer businesses

- SBA 7(a) programs evaluate comprehensive business plans, industry experience, and owner track record beyond operating history

- Revenue-based financing focuses on growth trajectory and business model viability

- Owner personal credit score and net worth partially offset lack of business history

Bad Credit Doesn't Automatically Disqualify You

While credit scores matter, they're one factor, not the only determinant:

- SBA programs specifically accommodate borrowers with challenged credit (minimum typically 630, though circumstances vary)

- Strong business fundamentals, demonstrated cash flow, and robust collateral can compensate for lower credit scores

- Recent credit problems carry less weight than historical patterns

- Non-bank lenders often apply more flexible credit criteria

Limited Collateral Options Don't Preclude Borrowing

Collateral requirements vary dramatically by loan program:

- SBA 7(a) loans require reasonable collateral but aren't exclusively asset-dependent

- SBA microloans emphasize business viability over collateral

- Revenue-based financing requires no traditional collateral

- Accounts receivable financing uses customer invoices as collateral

- Equipment financing uses purchased equipment as collateral

- Personal real estate, business assets, or accounts receivable can all serve as collateral

Women and Minority-Owned Businesses Access Specialized Support

The SBA actively encourages lending to women and minority-owned small businesses through:

- Set-asides and preferences in SBA loan programs

- Specialized lender networks serving underrepresented entrepreneurs

- Women's Business Center educational resources

- Minority Business Development resources

Seasonal Businesses Can Structure Appropriate Financing

Businesses with seasonal revenue patterns require specially structured financing:

- Seasonal lines of credit providing borrowing capacity during slow seasons, repayment during peak seasons

- Revenue-based financing scaling repayment with actual revenue

- Account receivable financing for rapid cash conversion

- Shorter-term loans matching seasonal working capital cycles

Qualification Trends Affecting Applicants

Based on market data, borrower qualification is becoming simultaneously more accessible and more data-driven:

More Accessible:

- Alternative credit data replacing FICO scores for some products

- Expanded consideration of business cash flow over personal credit

- Faster approval timelines through automated underwriting

- Lower minimum loan amounts enabling broader borrower access

More Data-Driven:

- Lenders increasingly using real-time business financial data (from accounting software integrations)

- Advanced analytics evaluating industry-specific risk models

- Loan structuring precision matching individual business cash flow patterns

- Predictive modeling improving approval decision quality

Sector-Specific Trends:

- Manufacturing: Supply chain financing gaining prominence

- Professional Services: Revenue-based financing growing

- Retail/Wholesale: Inventory financing and purchase order solutions expanding

- Healthcare: Medical practice lending stabilizing after regulatory shifts

- Technology: Venture debt complementing equity financing

Getting Started: Your Next Steps

Step 1: Schedule Initial Consultation

Contact Mountaintop Capital Partners to discuss your capital needs, timeline, and business fundamentals. Our financing specialists will recommend appropriate loan programs and explain the process in detail.

Step 2: Prepare Documentation Package

Gather initial financial documentation (recent tax returns, bank statements, business formation documents, profit & loss statements). Having materials organized accelerates the pre-qualification process.

Step 3: Complete Pre-Qualification

We'll conduct preliminary assessment determining loan program fit, credit adequacy, and realistic approval probability. This stage typically requires 2-3 business days and minimal documentation.

Step 4: Proceed to Full Application

Upon positive pre-qualification, submit comprehensive documentation for underwriting review. Our team will guide document collection ensuring completeness.

Step 5: Underwriting and Credit Decision

Our underwriting team conducts detailed credit analysis and feasibility review. You'll work with your relationship manager throughout this stage, responding promptly to information requests.

Step 6: Closing and Funding

Upon approval, we prepare loan documentation, coordinate closing, and arrange fund disbursement to your business account.

%20Loans.png)

.png)

.png)

.png)

.png)