Mountaintop Capital Partners LLC structures financing that tracks commodity cycles and field operations. We arrange working capital, equipment funding, project and acquisition debt, and receivables facilities so you can win contracts, keep crews moving, and protect liquidity.

At a Glance

- Facilities: reserve and asset-based revolvers, term loans, equipment loans and leases, receivables and contract financing, project and infrastructure debt, acquisition and growth capital

- Use of proceeds: drilling and completions, workovers, lease operating expenses, pipeline and facility upgrades, compression, rigs and rolling stock, M&A, refinancing eligible obligations

- Borrowers we serve: E&P sponsors, midstream operators, oilfield service companies, equipment owners, logistics and maintenance providers.

Solutions that Match Field Realities

- Working capital and receivables : Align cash to job progress and pay terms. We place revolving lines sized to eligible invoices, MSAs, and contract backlogs. See Accounts Receivable Financing and Invoice Financing for faster cash conversion.

- Equipment and fleet: Fund rigs, trucks, frac irons, pumps, compressors, and production equipment with fixed-payment Equipment Loans or leases that fit duty cycles and maintenance schedules.

- Projects and infrastructure: For gathering, processing, storage, and facility work, we structure construction-to-term bridges and long-dated takeouts. Owner-operators can compare Commercial Real Estate Loans for yards, shops, and terminals.

- Everyday flexibility: Set a revolving facility for fuel, payroll, and vendors with Bank Lines of Credit. For short-duration needs, compare Short-Term Loans.

Where this Financing Helps

- Winning bids that require proof of capital and rapid mobilization

- Managing price volatility with hedged borrowing bases and covenant flexibility

- Scaling crews and equipment for new pads, turnarounds, and outages

- Bridging slow pay from primes and majors without straining vendor relationships

- Refinancing higher-cost obligations to improve monthly cash flow.

Eligibility Snapshot

- US entity with operating history or experienced principals

- Executed MSAs or credible pipeline of work, or reserves and hedges for E&P

- Clean corporate structure, insurance, and HSE compliance

- Reasonable leverage and evidence of cash flow or contracted availability

- Final terms subject to underwriting, collateral eligibility, and legal documentation

What You Will Need

- Corporate documents, EIN, ownership chart, identification for principals

- Two to three years financials and tax returns where available, current interim statements

- Twelve months bank statements, AR aging, and major customer list with pay terms

- Equipment list with specs and VINs, or reserve and engineering reports for E&P

- Copies of MSAs, contract awards, backlog, and insurance certificates

- Project budgets, schedules, and use-of-funds for capex requests

- KYC and AML documentation

Process

- Discovery and sizing based on assets, contracts, reserves, and use of proceeds

- Market and term sheets from banks, ABLs, private credit, and specialty energy lenders

- Diligence and approvals including collateral tests and third-party reports as required

- Closing and funding with transparent fees, clear covenants, and defined draw procedures

Why Mountaintop Capital Partners?

- Multi-lender energy access that creates real pricing power and better structures

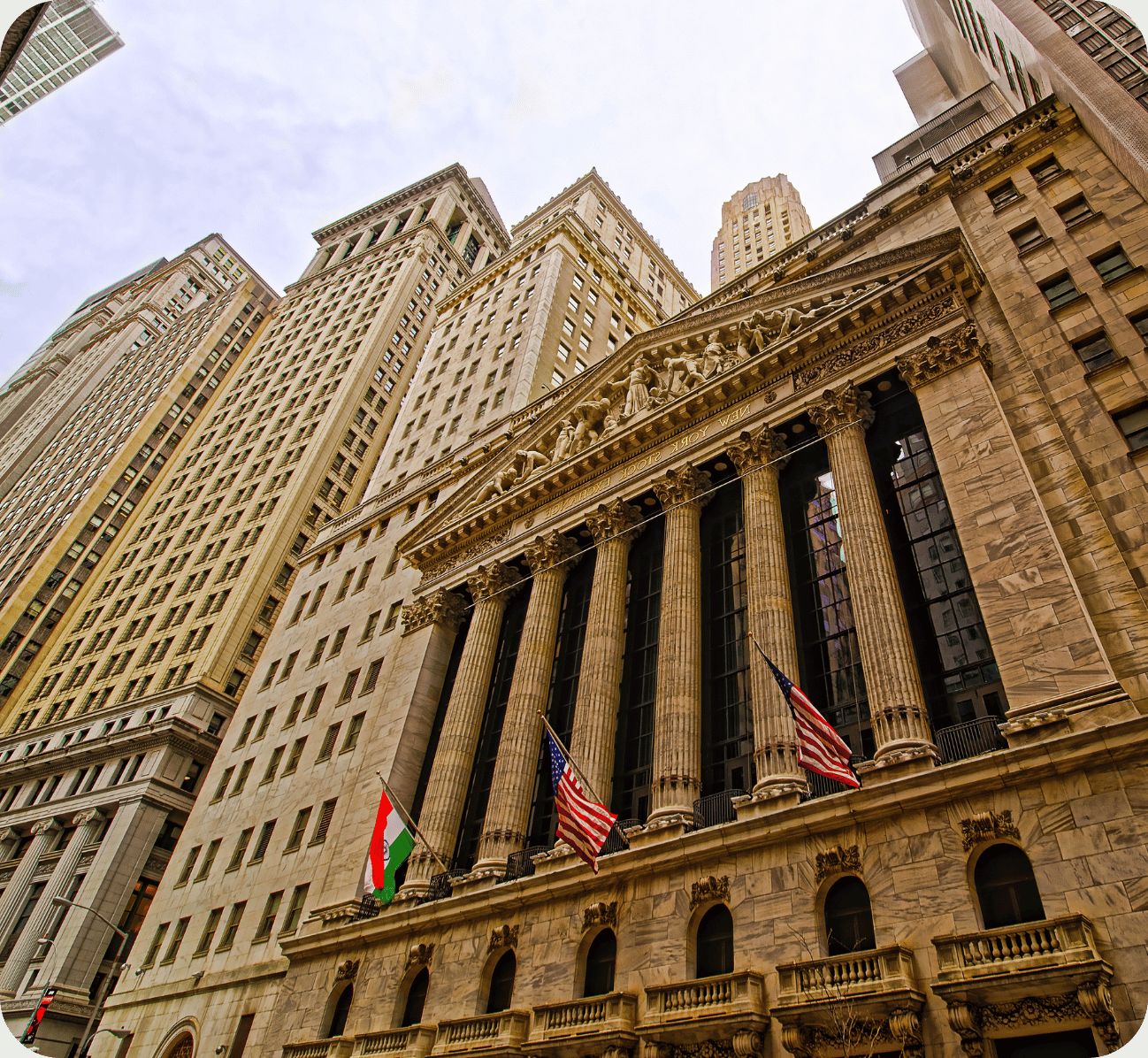

- Wall Street trained team focused on certainty of execution and disciplined documentation

- Single senior contact coordinating lender, counsel, title, and third parties

- Encrypted client portal, rigorous KYC and AML, transparent economics from start to finish

%20Loans.png)

.png)

.png)

.png)

.png)