Revolving capital to smooth cash flow, capture supplier discounts, and fund projects fast.

What is a Bank Line of Credit

A bank line of credit is a revolving facility that lets your company draw, repay, and redraw up to an approved limit. You pay interest only on the amount outstanding. Facilities can be unsecured for strong credits or secured by receivables and inventory. Lines are ideal for timing gaps, seasonal inventory builds, progress billing, and contingency reserves.

When a Line of Credit Makes Sense

- Manage working capital during growth, seasonality, or extended payables

- Capture early-pay supplier discounts and negotiate stronger terms

- Fund project mobilization before progress payments arrive

- Bridge timing to permanent financing or term debt when appropriate

If your need is a fixed asset purchase, consider Equipment Loans. For owner-occupied property, see Commercial Real Estate Loans. For broader use of proceeds, compare SBA 7(a) Loans.

How it Works?

We size the facility to your cash conversion cycle, then structure secured or unsecured options with clear advance rates and covenants. Pricing typically references base rate plus a margin with interest billed monthly. Funds are accessed by ACH or wire and can be repaid at any time to reduce interest. Annual renewals include limit reassessment and collateral reviews when applicable. If your receivables are the primary collateral, we may pair the line with Invoice Financing or Accounts Receivable Financing for higher availability.

Typical Terms We Arrange

- Limits: From lower mid-six figures to multi-million based on needs and capacity

- Tenor: One-year revolving, renewable with financial performance

- Interest: Variable base rate plus spread, interest on drawn balance only

- Collateral: Unsecured or secured by AR and inventory with standard UCC filings

- Fees: Commitment or unused line fees may apply, disclosed upfront

What You Will Need

- Last 6 to 12 months of business bank statements and current AR aging

- Two to three years of financial statements and business tax returns

- Organizational documents, ownership chart, and IDs for principals

- Basic projections and a use-of-funds summary

If you are early-stage and need a simpler path, review Business Loans for Startups. For quick, defined-term capital, see Short-Term Loans or Online Term Loan.

Why Mountaintop Capital Partners?

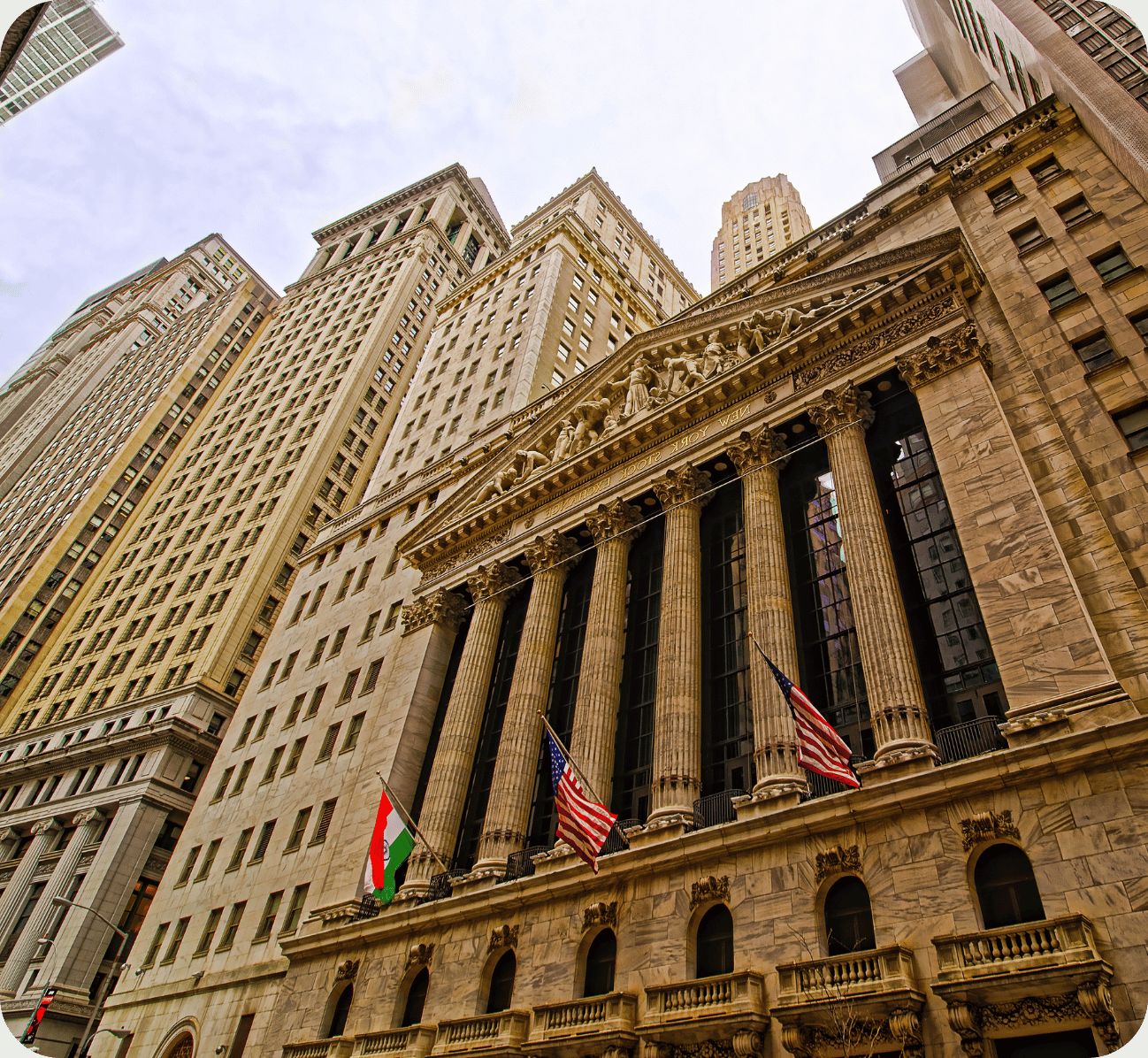

- Wall Street discipline: We negotiate pricing, covenants, and collateral terms with leading banks

- Speed with certainty: Streamlined underwriting and a single senior point of contact from sizing to close

- Better availability: Ability to integrate AR and inventory borrowing bases for higher advance rates

- Security by design: Encrypted client portal, rigorous KYC and AML, clear documentation and renewal timelines

%20Loans.png)

.png)

.png)

.png)

.png)