Mountaintop Capital Partners LLC funds clinics and physician groups with structures that respect payer cycles and growth plans. We arrange working capital, equipment financing, and owner-occupied real estate loans, then manage underwriting to a clean, on-time close.

At a Glance

- Facilities: revolving working capital lines, term loans, equipment loans and leases, receivables facilities, owner-occupied real estate, acquisition and partner buyout financing

- Use of proceeds: payroll, inventory and supplies, EHR and technology, imaging and lab equipment, buildouts, acquisitions, refinancing of eligible debt

- Timing: indications after document review, closings targeted on a defined calendar

Solutions Built for Medical Cash Flow

Reimbursements arrive on payer timetables, not yours. We structure Bank Lines of Credit against predictable cash flow so you can cover payroll, supplies, and expansion. For larger purchases, we place fixed-payment Equipment Loans that match the life of the asset. If you own or plan to own your building, we arrange Commercial Real Estate Loans and compare SBA 7(a) Loans with SBA CDC/504 Loans. When claims age stretches, we deploy Accounts Receivable Financing or Invoice Financing to accelerate collections without disrupting operations.

Who We Finance

Physician groups, dental and orthodontic practices, ASCs, behavioral health, physical therapy, imaging centers, urgent care, veterinary clinics, home health and hospice, concierge medicine, and multi-site rollups.

Use Cases We Fund

- Launch a de novo clinic or add locations with buildout and working capital

- Acquire a practice or buy out a partner while preserving liquidity

- Upgrade imaging, lab, dental, or surgical equipment with predictable payments

- Smooth cash between insurer remits, deductibles, and seasonal volume

- Refinance higher-cost obligations to improve monthly cash flow

Eligibility Snapshot

- US practice with experienced ownership or clinical leadership

- Evidence of payer mix and reimbursement history or credible projections for new sites

- Solid collections processes and clean billing practices

- Collateral and DSCR requirements vary by facility and lender

- Final approval depends on lender credit review

What You Will Need

- Entity documents, EIN, ownership chart, IDs for principals

- Two to three years financials and tax returns where available, current interim financials

- Twelve months bank statements and a payor mix report or payer contracts

- A/R aging and revenue cycle metrics, equipment quotes or project budget

- Lease or property details for real estate requests

- Business plan with 24-month projections and use of funds

- KYC and AML documentation

Process

- Discovery and sizing to align capital with payor cycles and clinic milestones

- Market and term sheets from targeted banks, healthcare lenders, and private credit

- Diligence and approvals including third-party reports where required

- Closing and funding with clear covenants, fee transparency, and a defined timeline

Why Mountaintop Capital Partners?

- Multi-lender access that creates pricing power and tailored structures for healthcare

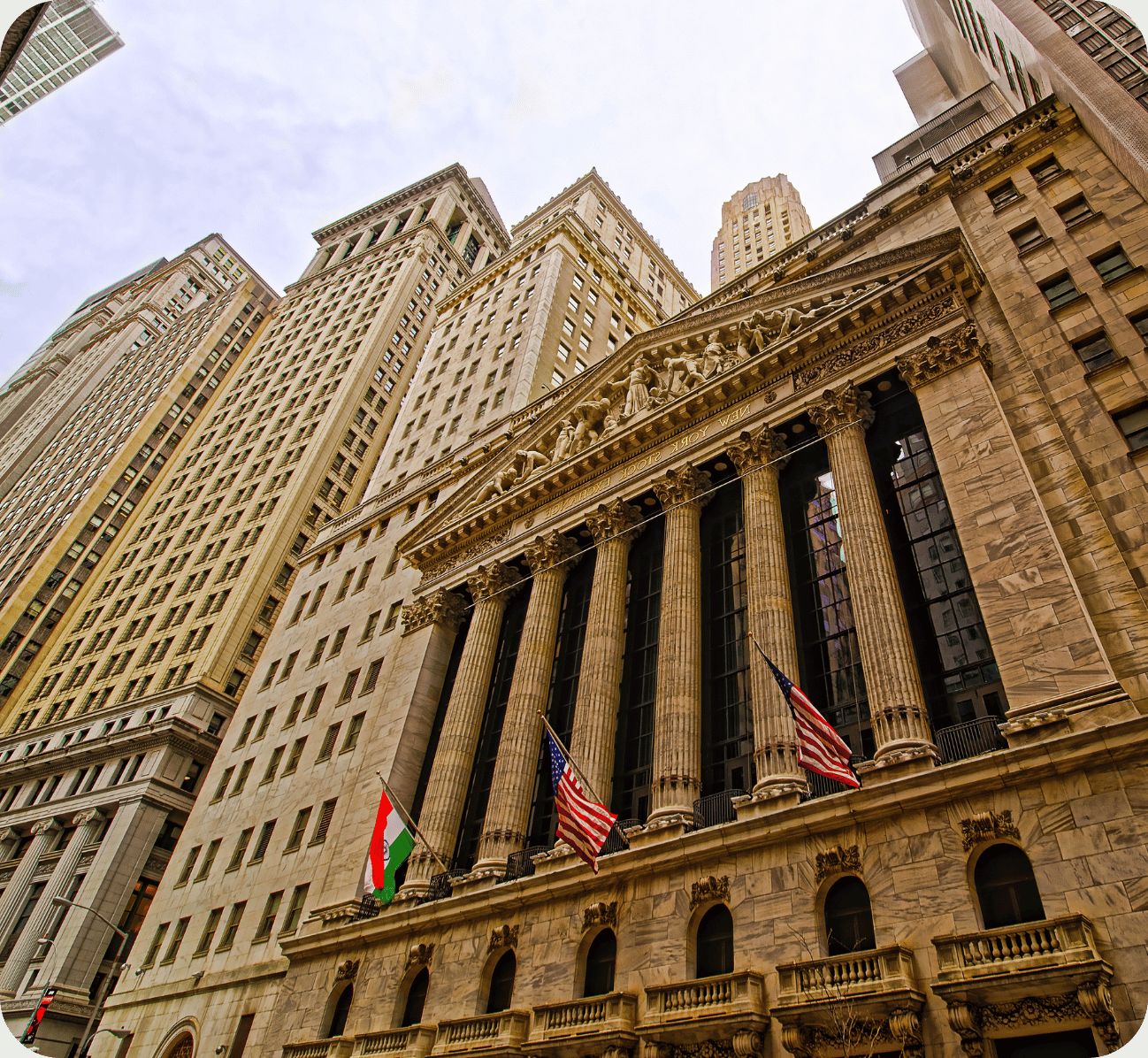

- Wall Street trained team focused on certainty of execution and clean documentation

- Single senior contact coordinating lender, counsel, appraisers, and escrow

- Secure 256-bit encrypted portal with rigorous KYC and AML

%20Loans.png)

.png)

.png)

.png)

.png)