A Bank Guarantee is a promise from a regulated bank to pay the beneficiary if the applicant fails to meet a contract obligation. BGs lower counterparty risk in trade, construction, leasing, and project finance, and are typically issued under ICC URDG 758 rules with delivery by authenticated SWIFT.

What a Bank Guarantee Covers

Banks can issue several forms of protection so your counterparties feel secure and you can move faster:

- Performance Guarantee protects delivery, completion, or service levels.

- Financial Guarantee secures monetary obligations such as rent or installment payments.

- Advance Payment Guarantee covers repayment of mobilization or prepayments if terms are not met.

- Bid or Tender Bond backs a bid and converts to a performance guarantee at award if required.

Our BG Solutions

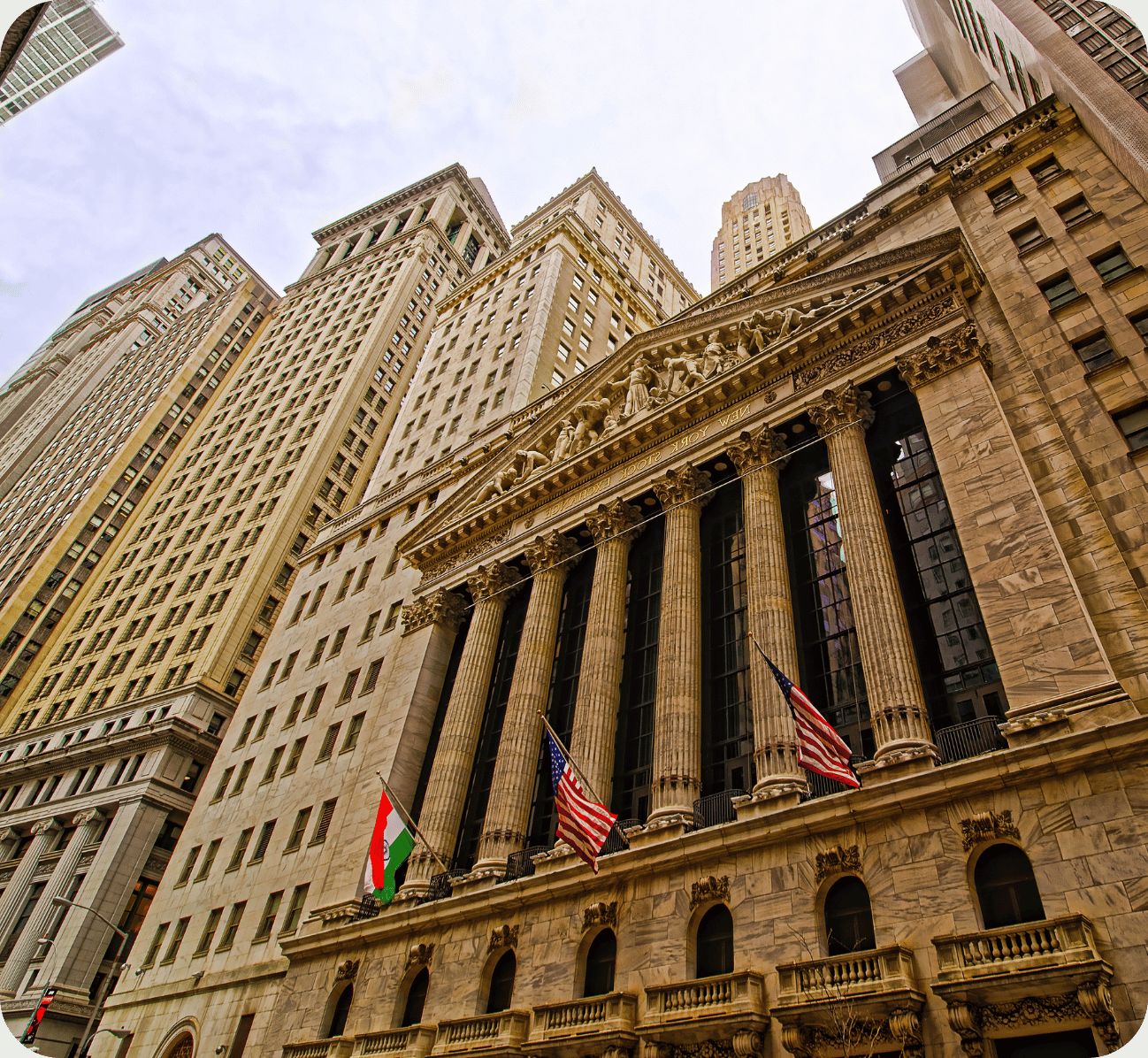

Mountaintop Capital Partners LLC structures and arranges BG issuance through Tier-1 and premier regional banks. We coordinate terms, draft compliant wording, and manage end-to-end delivery so the instrument lands correctly with the beneficiary.

.png)

What We Handle for You

- Term sheet design that aligns with your contract and draw conditions

- Selection of URDG 758 or jurisdictional wording, with clear expiry and claim terms

- Issuance via SWIFT MT760, with MT799 pre-advice when needed

- Amendments, extensions, assignment of proceeds, and cancellations

- Optional confirmation to add a second bank’s credit for extra security

Where a BG Adds Value

BGs are widely used for cross-border shipments, EPC and construction projects, leases and concessions, advance payment protection, warranty and retention releases, and any large contract where the beneficiary needs comfort beyond the applicant’s balance sheet.

Eligibility and Documentation

Banks complete KYC and AML onboarding and review credit strength. Expect corporate formation documents, ownership and IDs, recent financials, contract or purchase order, beneficiary details, and any collateral or margin required by the issuing bank.

Process and Timeline

- Scope value, tenor, beneficiary, and form of guarantee

- Submit KYC package and transaction documents

- Receive bank terms and fees, execute the mandate, remit charges or margin

- Bank issues BG by SWIFT and forwards originals if required

- Ongoing support for amendments, extensions, and release at expiry

- Typical issuance time is 5 to 12 business days after compliance approval.

Fees, Tenor, and Expiry

Pricing is an annualized percentage of the face amount plus issuance and SWIFT charges. Most BGs run 3 to 24 months with options to extend or auto-renew on milestone completion.

Compliance Matters

All guarantees are issued by regulated institutions and subject to KYC, AML, and sanctions screening. We maintain a secure 256-bit encrypted client portal and provide full fee disclosure before you commit.

Why Mountaintop Capital Partners?

- Wall Street trained structuring for clear, bankable guarantee wording

- Direct access to Tier-1 banks for faster underwriting and reliable SWIFT delivery

- Single point of contact to coordinate bank, beneficiary, and counsel

- Transparent costs and secure workflow with encrypted document exchange

- Post-issuance support for amendments, extensions, and claim guidance

%20Loans.png)

.png)

.png)

.png)

.png)